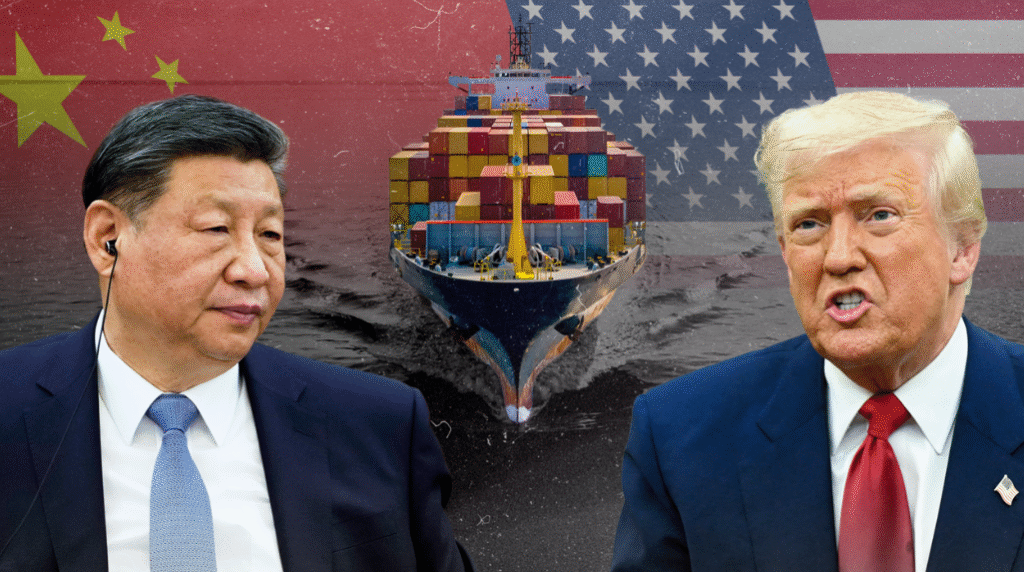

Wall Street reacts as US-China negotiations signal a potential breakthrough in global trade relations.

🌐 Intro:

In an era dominated by economic uncertainty, the world has finally received a glimmer of hope: renewed momentum in the long-stalled China US trade deal discussions. Over the past week, reports of progress in the US China trade deal have reverberated across financial markets, reigniting investor confidence and optimism.

Key focus areas such as China tariffs, US China tariffs, and the broader impacts on supply chains and inflation are under negotiation. Simultaneously, investors are closely tracking stock futures now, which are climbing in response to this geopolitical thaw.

🔍 What’s New in the China US Trade Deal?

The latest round of talks involves high-level meetings between U.S. Treasury Secretary Janet Yellen and Chinese Vice Premier He Lifeng. These meetings aim to unwind some of the tariffs imposed during the U.S.-China trade war initiated in 2018.

According to inside sources, both countries are considering:

- Phased removal of selected tariffs

- Regulatory cooperation on export controls

- Frameworks for dispute resolution

🔥 Summary:

The latest China US trade deal discussions aim to roll back US China tariffs, stabilizing markets and boosting investor sentiment worldwide.

This renewed cooperation comes after several years of economic tension, and both sides seem motivated to stabilize what has become a strained economic relationship.

📈 How Are Markets Reacting? – Stock Futures Now

Markets have reacted swiftly and positively. The news has created bullish sentiment globally. Here’s how major indices responded in pre-market trading:

- Dow Jones futures: +1.3%

- S&P 500 futures: +1.5%

- Nasdaq futures: +1.9%

These gains indicate growing confidence among investors that a potential easing of trade tensions could benefit multinational corporations and small businesses alike.

Asian markets followed suit:

- Shanghai Composite Index: +2.4%

- Hang Seng Index: +3.1%

The rally is especially significant in sectors closely tied to global supply chains, including tech, automotive, and manufacturing.

🏭 Rewinding the Tariff War: The US China Tariffs

The U.S.-China trade war began in earnest in 2018 under the Trump administration, targeting what the U.S. described as “unfair trade practices” by China. This led to:

- Imposition of Section 301 tariffs on over $300 billion in Chinese goods

- China’s retaliatory tariffs on U.S. agricultural products and technology

- Ongoing instability in global trade flows

Fast forward to 2025, and the economic damage has become more evident. With inflation pressures and fragile supply chains, there’s renewed urgency on both sides to resolve these long-standing issues.

The current talks aim to:

- Remove tariffs that disproportionately hurt small businesses

- Support inflation control by lowering import costs

- Re-establish stable trade norms

💼 Who Gains from the China Trade Deal?

This deal isn’t just about tariffs—it could reset the foundation for several industries:

| Sector | Impact |

|---|---|

| Agriculture | Greater access to Chinese markets for American soybeans, pork, and corn |

| Technology | Eased restrictions on chips and components benefit tech manufacturers |

| Retail | Lower tariffs reduce prices of consumer electronics and apparel |

| Automotive | Better market access for U.S. EV manufacturers |

Both countries recognize that economic interdependence can be a tool for peace and prosperity, especially amid global uncertainties.

📊 What Analysts Are Saying

Global financial experts are weighing in on the possible outcomes of the ongoing negotiations:

- Morgan Stanley: “Even partial tariff relief could add 0.3% to U.S. GDP.”

- Goldman Sachs: “A realistic, phased deal may be achievable by Q3.”

- JP Morgan: “A resolution would solidify confidence in recovering supply chains.”

These perspectives underscore the high economic stakes and the vast opportunities a deal could unlock.

🕵️♂️ Political Implications: Beyond the Economy

While economic recovery is a key driver, political strategy is also at play:

- President Joe Biden faces voter pressure over inflation; a reduction in tariffs could lower consumer prices without diplomatic compromise.

- President Xi Jinping is under domestic pressure to stimulate China’s sluggish economy and avert further downturns in manufacturing and exports.

Thus, both sides are highly motivated to present this trade deal as a win for national interests while subtly redefining the rules of engagement.

🌍 Global Reactions to the China US Trade Deal

The rest of the world isn’t standing idle:

- European Union: Watching closely for ripple effects on its own export policies.

- India & ASEAN Nations: Monitoring potential shifts in supply chains.

- Developing economies: Hoping to capitalize on trade diversions and new investment opportunities.

If the deal materializes, it could prompt a new wave of trade agreements and shift the global balance in economic influence.

🧐 Frequently Asked Questions (FAQs)

❓ What is the China US trade deal about?

The deal centers on reducing tariffs and fostering mutual trade growth between the U.S. and China. It includes provisions for phased tariff rollbacks and regulatory cooperation.

❓ Why were the US China tariffs imposed initially?

They were introduced to counteract what the U.S. viewed as unfair trade practices, including IP theft and forced technology transfers.

❓ Are stock futures rising due to the trade deal?

Yes. Optimism about a resolution is pushing stock futures now to multi-month highs, reflecting bullish investor sentiment.

❓ When will the trade deal be finalized?

While no specific date is set, insiders anticipate a preliminary framework could be reached by the upcoming G20 Summit.

❓ How will the deal affect inflation?

By reducing tariffs, the cost of imported goods could decline, alleviating inflationary pressure.

📌 Key Takeaways

- The China US trade deal could roll back damaging US China tariffs.

- Stock futures now reflect strong optimism.

- Key sectors like agriculture, tech, and manufacturing stand to gain significantly.

- Both nations are balancing economic goals with political optics.

- A formal agreement could reshape global trade norms.

🔮 What Happens Next?

Looking ahead, the upcoming U.S.-China Economic Working Group meetings will be crucial. Experts suggest that progress there could set the stage for an official announcement during the G20 Summit in Osaka.

Investors will continue to watch trade talks, policy updates, and stock futures now for signs of resolution. Meanwhile, companies are already preparing their supply chains to adapt to a potentially smoother trade environment.

📅 Final Thoughts

The world may be standing on the brink of a new era in international commerce. While challenges remain, the renewed US China trade deal momentum brings the possibility of restoring trust, balancing power, and revitalizing the global economy.

This isn’t just a deal—it’s a signal that cooperation might once again trump confrontation on the global stage.