Running late on your taxes? Don’t sweat it. The IRS income tax extension for 2025 could be your best-kept secret to staying penalty-free. Here’s everything you need to know—explained simply, with zero legal jargon, and plenty of smart tax-saving tips.

🌟 Why Tax Extension 2025 Is a Lifesaver (and Not Just for Procrastinators)

Let’s bust a myth right off the bat—filing a tax extension isn’t a red flag or a lazy move. In fact, it’s often the smartest choice for those navigating complex tax situations or simply needing more time to file accurately.

In 2025, with the rise of freelancers, remote workers, crypto traders, and side-hustlers, millions of Americans are finding themselves in tax chaos. Delayed forms, last-minute expenses, and tax code confusion are real. That’s where the extension on taxes becomes your best friend.

📅 Important Tax Extension Deadlines in 2025

Here’s the golden rule: if you want an extension, you must file for it by April 15, 2025. This is the original tax deadline for most filers.

If your request is approved—which it usually is—you’ll get an automatic six-month extension. That pushes your new deadline to October 15, 2025.

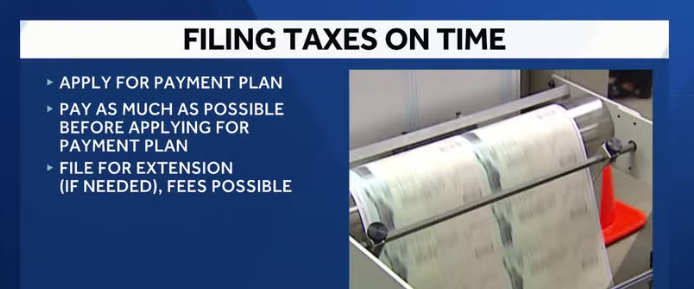

But here’s the kicker: the extension only gives you more time to file—not to pay. That means you still need to estimate your tax bill and pay what you owe by April 15 to avoid penalties or interest.

🛠️ How to File an IRS Income Tax Extension in 2025 (Step-by-Step)

Filing for a tax extension in 2025 is easier than ordering takeout. Here are the three main methods:

1. Use IRS Free File (for incomes under $79,000)

The IRS partners with private tax software companies to offer free electronic filing. Just go to IRS.gov and submit Form 4868.

2. Use Tax Software or a Tax Pro

Whether you use TurboTax, H&R Block, TaxAct, or a trusted accountant, they’ll walk you through the process of filing a tax extension 2025.

3. Mail It In

Old-school? Download and fill out Form 4868, then mail it to the correct IRS address for your region. (Tip: Send it certified so you have proof of mailing.)

✅ Pro Tip: Even if you can’t pay your full tax bill now, still file the extension. It reduces your penalty significantly compared to not filing at all.

🤔 Who Should Consider Filing an Extension on Taxes in 2025?

Tax extensions aren’t just for people who forgot. They’re strategic tools. Here’s who benefits most from filing one:

- 📈 Freelancers and gig workers waiting on multiple 1099s

- 💼 Business owners finalizing expenses and deductions

- 💍 Newlyweds or divorcees adjusting their filing status

- 🌍 Expats and military personnel abroad during tax season

- 💰 Crypto or real estate investors waiting on complex K-1 forms

- 😷 People recovering from illness or dealing with emergencies

If this sounds like you, filing an irs income tax extension could save you from stress—and costly errors.

💸 What Happens If You Don’t File or Pay? tax extension 2025

Let’s break this down with a little real talk: not filing and not paying are two different things—and they come with different consequences.

⚠️ Late Filing Penalty

5% of your unpaid taxes per month (up to 25%)

⚠️ Late Payment Penalty

0.5% of unpaid taxes per month

⚠️ Interest

Daily compounding interest on unpaid taxes based on federal rates

💡 Best Case Scenario: File for the extension AND pay what you can. You’ll avoid the worst penalties and interest.

📊 Snapshot: Key Facts About the IRS Income Tax Extension 2025

| What It Is | 6-month extension to file federal income tax return |

|---|---|

| Form Needed | Form 4868 |

| Filing Deadline | April 15, 2025 |

| Extended Deadline | October 15, 2025 |

| Extra Time to Pay? | ❌ No—only more time to file |

| Online Filing Options? | ✅ Yes (Free File, TurboTax, etc.) |

🤯 Common Tax Extension 2025 Myths—Busted!

❌ Myth 1: Filing an extension increases audit risk

Truth: Nope. The IRS doesn’t view extensions negatively or as red flags.

❌ Myth 2: You need a reason to file

Truth: No explanation needed. The IRS grants automatic approval for timely requests.

❌ Myth 3: You can delay paying your taxes

Truth: Extension on taxes = filing extension, not payment extension.

🎯 After You File: What Comes Next?

Filing your extension is just the first step. Here’s how to make the most of your time until the October deadline:

- ✅ Organize Your Documents

Gather W-2s, 1099s, receipts, medical bills, investment statements, and deduction records. - 🧠 Calculate What You Owe

Even if it’s rough, pay something by April 15 to reduce your penalties later. - 📆 Set a Reminder for October 1st

Don’t be the person scrambling on October 14. Plan ahead!

🙋 Frequently Asked Questions

📌 Can I get an extension on state taxes too?

Most states mirror the federal extension but some require separate forms. Check with your state’s tax department.

📌 What if I’m abroad on April 15?

U.S. citizens living abroad get an automatic 2-month extension to June 15, but still need to pay estimated taxes by April 15. You can file Form 4868 to get even more time.

📌 Do I need to attach Form 4868 when I eventually file?

Nope. Just file your completed return by October 15. The IRS already has your extension on file.

🔍 Google Snippet-Ready Answers

How do I file a tax extension in 2025?

File IRS Form 4868 by April 15, 2025, either online via IRS Free File or tax software. This gives you until October 15, 2025, to file your federal return, but payment is still due by April 15.

Does filing an extension give me more time to pay taxes?

No. The IRS tax extension only gives you more time to file your return. Taxes owed must still be paid by April 15 to avoid penalties and interest.

🚀 Final Thoughts: Filing a Tax Extension in 2025 Is Smarter Than You Think

Let’s face it—tax season can be overwhelming. But with a tax extension 2025, you buy yourself the most valuable thing of all: time. Time to gather documents, get professional help, and file accurately. Time to avoid costly mistakes.

Whether you’re a small business owner, a crypto investor, or just someone going through a lot right now, the irs income tax extension is your stress-free ticket to staying compliant and in control.

So don’t rush, don’t panic—just file that extension.